|

|

|

|

|

|

|

Contents

|

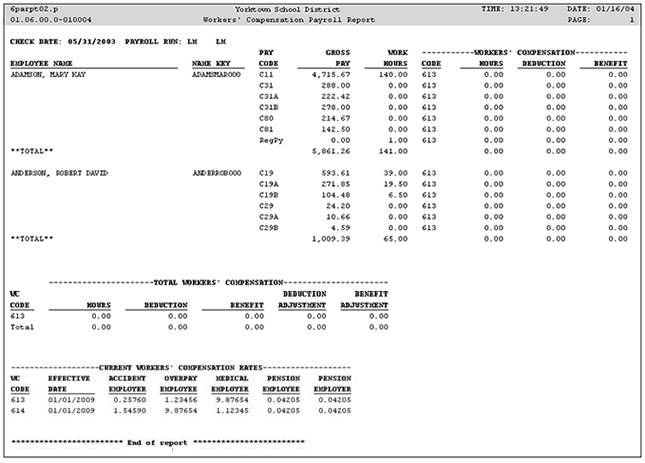

The Workers’ Compensation Payroll Report consists of three sections – an Employee Information section, a Summary section, and a Rate Information section. The Employee Information section of the report lists the hours, wages, and amounts associated with Workers’ Compensation tax deductions and benefits processed in the current payroll. Any Workers’ Compensation adjustments processed will also be included in this section. The Summary section will summarize, by Workers' Compensation Code, the deductions and benefits reported in the Employee Information section. The Rate Information section lists the rates currently in effect for each Workers' Compensation Code.

The Current Workers’ Compensation Rates are listed at the bottom of the report.

For districts that are self-insured for workers’ compensation, who have selected the Payroll Configuration Option, “Use WC Self-Insured Overpayment Rate” the value in the Medical Aid Employee Rate field is used for the Overpayment Reimbursement Fund Rate, and is displayed as follows:

For districts that are not self-insured for workers’ compensation, who have not selected the Payroll Configuration Option, “Use WC Self-Insured Overpayment Rate” the value in the Medical Aid Employee Rate field is used for the Medical Aid Rate, and is displayed as follows:

Page Updated 9/09